The Asset Value of Employees

The true value of employee assets cannot be standardized with a simple, flat ratio. Studies performed around the world have shown results vary.

- By Thomas F. Heim

- Apr 01, 2015

Understanding the value of the employee as an asset and not an expense is essential in the development and implementation of a human capital risk management framework to protect and enhance the productive asset class known as "Employee."

Risk management seeks to protect corporate assets and stakeholders, enhance and strengthen free cash flow, and safeguard balance sheets. Traditional focus has been on the protection of corporate assets, such as property, product, and brand, from risks including fire, flood, wind, earthquake, recall, professional negligence, and manufacturing. Modern risk management theory is focused on moving from a silo-centric division, unit, team, or process-specific methodology into an enterprise-wide platform. This corporate "top down" and "bottom up" strategy seeks to define, identify, quantify, measure, mitigate, and manage the risks impacting assets and stakeholders. Lost in this global enterprise risk management movement are the recognition, identification, and treatment of human capital as an asset worthy of protection.

Assets are resources controlled by an organization from which economic benefits are expected to flow to the enterprise. The chief function of an asset, either used individually or in combination with other assets, is to generate current and future cash flows to meet the needs of the organization and corporate stakeholders.

Seen here, the three major asset classes fundamental to the existence of organizational value are financial, physical, and intangible, which includes human capital, or employees.

Human Capital Asset Risk Management

Human capital is unlike other assets and is often overlooked as part of broader integrated risk management programs that traditionally focus on corporate physical assets. On one hand, staff represents the single greatest potential asset to the enterprise. Simultaneously, new and long-term employees represent the single greatest potential liability that an organization faces as it conducts its business.

While there are other intangible assets, human capital is the only intangible asset that can be influenced but never completely controlled, invested in wisely or wasted thoughtlessly, and still have tremendous value. These distinguishing features also make human capital a unique and elusive asset.

Employee assets are controlled by their employer and provide some level of benefit that flows to the enterprise, either by themselves or in combination with other assets generating current and future cash flows. They provide services or produce goods that generate revenue for organizational stakeholders.

The common declaration that "employees are our greatest asset" is often long on hyperbole and short on substance, as all too often the realities of business get in the way and the productive value of employee assets is overlooked against a backdrop of production, expense, supply, and demand. This risk management methodology seeks to combine and extend the definitions, goals, objectives, and metrics of the corporate risk management program with the opportunities, hazards, and threats faced by human resources. Additionally this framework seeks to create measurable improvements to enterprise-wide employee safety, health, and welfare while adding a significant level of economic benefit to companies.

Human Capital Asset Valuation

"Human Capital Risk Management" strives to define, identify, evaluate, and manage risk that could impact employees’ performance and reduces or prevents them from accomplishing their part of the corporate mission.

Determining the value of tangible and intangible real and personal business assets is, for the most part, relatively straightforward. However, the valuation of employees for purposes of analyzing the loss of use they represent is significantly more complicated, made all the more so by key factors including:

- Lack of acceptance by businesses

- No standards as regards asset categories, definitions, employee type, and business size

- Varying methodologies reflecting cost, calculation, and measurement

- Lack of human resource accounting treatment

- Concept is highly individualistic and tailored to a specific business entity

- Lack of uniform data for analysis

The asset value of human capital is closely tied to overall corporate productivity and profitability measured in terms of hourly output and total output of goods and services. In the absence of employees or when employees' usefulness is limited in some capacity, their value as an asset class is reduced because they are unable to create current and future cash flows at the level they are expected to perform in order to achieve a certain financial return.

The value of an employee asset can be decreased either temporarily or permanently based on the severity of a workplace or work-related loss event. Typically the costs of these injuries can be grouped into three categories: direct, indirect, and human. There is no consensus regarding what each category comprises. Generally speaking, direct costs consist of components associated with the treatment and "repair" of the injury, such as medical costs. Direct cost data are usually quite easy to obtain and do not require the use of special estimation methods. Indirect costs are considered to be costs related to the lost opportunities for the injured employee, the employer, co-workers, and the community. They consist mainly of salary costs, administrative costs, and productivity losses. Compared with direct costs, indirect costs are usually more difficult to measure and are rarely insured.

Human costs relate to the value of the change in the quality of life of the worker and the people around him or her. While direct and indirect costs can be quantitative in nature, calculating the human cost becomes quite the exercise in socioeconomics. Human costs also include a broad category of what are called hidden costs. These include tangible and intangible costs of accidents at work and work-related injury or illness that cannot be valued in monetary terms, including staff morale, overtime, downtime, corporate image, and customer relations.

Historically the easiest and simplest way to measure the ultimate cost of an accident that can be related to productivity was to multiply the actual direct costs by a factor of 4 (Heinrich). This direct/indirect ratio says that for every $1 in direct expenses there are going to be $4 in indirect expenses. A $1,000 workers' compensation claim would have another $4,000 of indirect expenses. Productivity and profit would be measured against the single $5,000 to determine the true cost to the company. This theory was first introduced in 1939 and updated again in 1959. Over the course of the next 30 years, this remained the predominant theory.

Results have shown that there is no silver bullet when calculating the asset value of an employee. The true value of employee assets cannot be standardized with a simple, flat ratio. Studies performed around the world have shown results vary based on the following:

- A range of outcomes (0.85 through 1.5) might be likely based on size of claim, severity of the case, industry type, national health and social security system.

- The commitment and success of return to work programs.

- Company-specific accident at work analysis of short- and long-term expenses that can be applied to an employee by key component: people, environment, assets production, reputation, and society.

- Post-employment Employee Health Risk Assessment to collect and benchmark company workforce data that can be used in conjunction with other tools to determine and forecast the true costs of an employee injury.

Employee Risk Management

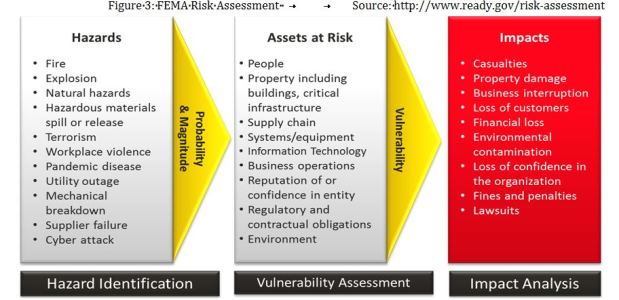

Risk management processes including "Enterprise Risk Management" have traditionally focused much of their efforts on defining, identifying, quantifying, measuring, mitigating, and optimizing the hazards, threats, exposures, and risks faced by organizations. An example of areas of significant risk that many organizations face, control, and mitigate can be seen here in Figure 1.

Risk management processes including "Enterprise Risk Management" have traditionally focused much of their efforts on defining, identifying, quantifying, measuring, mitigating, and optimizing the hazards, threats, exposures, and risks faced by organizations. An example of areas of significant risk that many organizations face, control, and mitigate can be seen here in Figure 1.

While enterprise risk management has been tasked to protect and enhance corporate assets, the management and mitigation of one of the largest exposures, employee asset risk, is mostly outside their entire purview, creating a paradox.

Expanding traditional employee health, wellness, and medical care management into a formalized employee asset risk management framework is critical to the success of any risk or enterprise management program. Success requires a collaborative and open communication environment.

There needs to be a common platform of clearly stated, measurable goals and objectives consisting of definitions, metrics, processes, roles, responsibilities, and ownership that cross all organizational silos.

Employee risk management cannot be focused solely on risks arising out of and in the course of employment. Employee assets face exposure 24 hours a day, seven days a week: home, travel, play, and work. A claim that happens outside of work can just as likely result in the same amount direct and indirect loss as one at work. Mitigating and managing these exposures requires a cohesive action plan that aligns heretofore individualistic operational units, as depicted here in Figure 2, into a platform that has a dual mandate to protect employees as corporate assets.

Employee risk management cannot be focused solely on risks arising out of and in the course of employment. Employee assets face exposure 24 hours a day, seven days a week: home, travel, play, and work. A claim that happens outside of work can just as likely result in the same amount direct and indirect loss as one at work. Mitigating and managing these exposures requires a cohesive action plan that aligns heretofore individualistic operational units, as depicted here in Figure 2, into a platform that has a dual mandate to protect employees as corporate assets.

Organizations must be willing to set aside traditional silos of employee health and welfare and work to develop and implement a greater dialogue joining together traditional risk management, employee health and safety, and human resources in an integrated employee asset risk management framework. Only then will organizations be prepared to manage the financial strain that obesity, diabetes, hypertension, smoking, coronary heart disease, metabolic syndrome, age, and others have on corporate balance sheets and on stakeholders. Failure to act now may impact not only employees, but also the company at large with regard to productivity, profits, and performance.

Assessing Human Capital Risk and Cost Drivers

An assortment of perils, hazards, threats, vulnerabilities, and risks can reduce the effectiveness or value of an asset (including people) in part or in whole. Around the globe various models are used by business to assess the impact a hazard has on a given asset at risk.

One common assessment tool is a business impact analysis and can be seen here in Figure 3. Prepared by the U.S. Federal Emergency Management Agency, this model determines overall impact of a hazard by measuring its probability and magnitude (severity) against the vulnerability of a particular asset at risk. The result (in this particular model) is the dollar cost impact that a hazard has on a particular asset at risk. It's interesting to note that "People" are at the top of their list of "Assets at Risk."

One common assessment tool is a business impact analysis and can be seen here in Figure 3. Prepared by the U.S. Federal Emergency Management Agency, this model determines overall impact of a hazard by measuring its probability and magnitude (severity) against the vulnerability of a particular asset at risk. The result (in this particular model) is the dollar cost impact that a hazard has on a particular asset at risk. It's interesting to note that "People" are at the top of their list of "Assets at Risk."

Human Capital Economic Risk Assessment

The true value of an economic appraisal is influencing the beliefs of decision-makers and policy makers in their language of finance. For maximum effectiveness in this respect, economic appraisal should be a joint activity of all stakeholders. An effective way is to make financial or economic estimations and give a realistic overview of the total costs of accidents and the benefits of preventing these.

When it comes to building an economic assessment, a word of caution is in order: Outcomes can be highly influenced by underlying assumptions, including variables and value. Collaboration between all parties is essential to ensure that what is being measured and reported is what is truly intended. Additionally, when metrics include variables outside the United States, care should be taken so that the values for each location are measured in a common fashion using a consistent monetary unit as currently valued. The cost factors and calculation principles should be adjusted according to the national practice of each country.

There are two predominant assessments:

- An evaluation of costs of a single accident or the total of accidents in a given period of time. Usually this is an ex-post evaluation.

- An assessment of economic effects of preventive action or accident prevention (cost-benefit analysis). This type of appraisal is generally used to assess the feasibility of an investment or to choose between alternatives.

An employee economic risk assessment should not be overly complicated, but structured to meet the needs of the organization and the goals of the team. A complicated model for the sake of being overly complicated should be avoided at all costs. If it cannot be easily explained and understood, the project is in jeopardy even if the quality and detail of the data is perfect.

This article originally appeared in the April 2015 issue of Occupational Health & Safety.